Click, Deliver, or Pickup? A Look at Online Ordering Trends in 2024

Field Agent wanted to understand a little bit more about online shopping in South Africa and how it influences home meal choices and grocery shopping behaviour. We surveyed 100 agents across the country to explore behaviours and opinions surrounding online ordering.

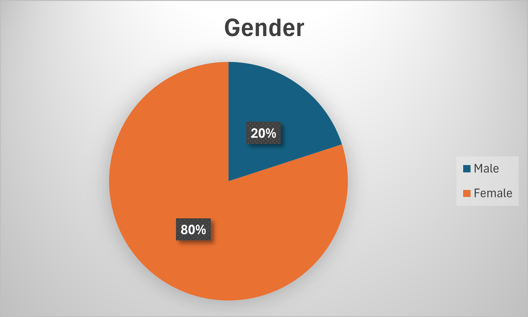

Out of the agents we surveyed, 80% were Female. 45% had a monthly household income of less than R10k, and 48% were aged between 20 and 30 years of age. (demographics shown below)

Almost 92% of all respondents indicated that online ordering was available in their areas. (see location map below)

We were particularly curious in the general make up of home meals. It was interesting to note that out of the respondents tested, on average, fast food comprised 52% of home meals. Home cooked meals comprised 29% and 19% were indicated as purchased ready-made.

When looking only at agents that had access to online purchases, we found that in general, 48% of general household grocery purchases were indicated as having been purchased online.

Accessibility

The apparent high level of online shopping accessibility, with a significant 92% of respondents indicating it's available in their area suggests a growing infrastructure for online ordering across various locations. For the remaining 8% of respondents, it would be interesting to identify the primary barriers to online ordering accessibility (e.g., perhaps a lack of internet, payment options, delivery services etc.)?

The below graphs reflect the portions of home meals reflected by the data:

Pre-prepared meals

Although, based on the sample, the proportion of pre prepared meals is relatively low (19%) as compared to fast foods (52%), a significant portion of these were ordered online. This might indicate that there is an opportunity for growth in pre-prepared foods; perhaps something to analyse further:

- What factors could drive increased adoption of pre-prepared meals (e.g. convenience, health trends, time constraints)?

- What are the competitive advantages and disadvantages of different pre-prepared meal models?

In Store Pickup

The survey also indicated a healthy appetite for picking up online orders at the store. 87% of all respondents indicated they choose in-store pickup for online orders, suggesting convenience and potentially faster turnaround times as key factors influencing their decision. Factors to investigate here could include:

- Does the preference for in-store pickup vary based on the type of product or order (e.g., groceries, electronics, clothing)?

- How does the preference for in-store pickup affect the role of physical stores in the retail landscape?

- How might advancements in delivery technologies (e.g., drones, autonomous vehicles) influence the preference for in-store pickup vs. delivery?

Online Grocery trends

When looking at online grocery delivery trends in more detail. It was interesting to note that 6% of respondents reported having all their groceries delivered, showcasing a segment comfortable with complete online grocery purchasing. However, a significant portion (41%) reported a mix of in-store shopping and online grocery delivery, with delivery percentages up to a third of their groceries. This suggests online grocery delivery is increasingly integrated into some consumers' grocery shopping habits but hasn't entirely replaced traditional in-store purchases. Further research into this topic could include:

- Do online orders for "groceries" include all food items, or does it exclude specific categories (e.g., fresh produce, meat)?

- What are the primary barriers preventing more consumers from adopting grocery delivery (e.g., cost, product availability, delivery speed)?

Fast Food Consumption and Online Ordering:

While the survey didn't delve into the overall dietary habits of respondents, it did explore the role of online ordering for fast food consumption. Interestingly, only 2% reported that 99% of their meals are fast food. However, a combined 48% stated their fast-food intake falls above 50% of their diet.

When it comes to online delivery for fast food, 8% of respondents said they get all their fast food delivered, while 58% reported utilizing delivery for at least half of their fast-food meals. This suggests a growing trend of online ordering for fast food.

Conclusion:

Based on the results of the above study, we were able to highlight several interesting trends that would warrant further investigation. The purpose of our study was not necessarily aimed at immediate answers to these questions, but more toward showcasing the need for and importance of probing research.

The data from this small sample has already indicated a high level of online order accessibility. It has also shown fast food to be dominant in the home meals “basket”. There is still room for significant grown in preprepared foods, given necessary investment and promotion. In store pickup options appear strong which would still support the need for in store purchases, although online grocery shopping is trending higher.

Embrace the Future: Let's redefine possibilities in 2024. To start click below:

Regards,

The Field Agent Team.